crypto tax calculator canada

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. Use a crypto tax calculator.

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada.

. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

Download Schedule D Form 8949 US only Reports and software imports eg. Generate complete tax reports for mining staking airdrops forks and other forms of income. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere.

Donate crypto to charity. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a buysell report. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

However it is important to note that only 50 of your capital gains are taxable. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

Similarly your crypto taxes for the 2022 financial year must be filed by the 30th of April 2023. Take the initial investment amount lets assume it is 1000. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada.

BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. TurboTax TaxACT and HR Block desktop 1000. A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes.

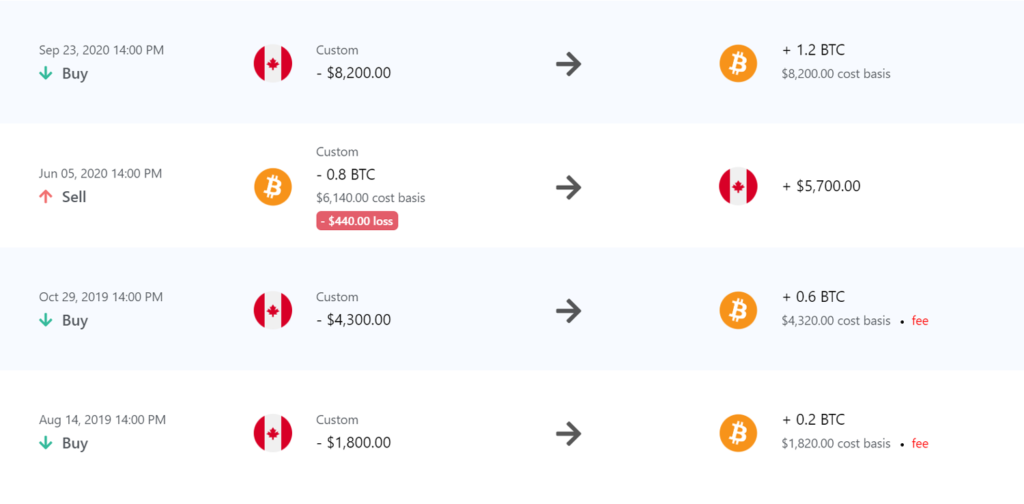

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. A simple way to calculate this is to add up all your capital gains and then divide this by 2. Heres an example of how to calculate the cost basis of your cryptocurrency.

Cryptocurrency is a term that refers to all digital currency but within this term there are many different types of coins and tokens such as. Bitcoin Litecoin Ripple Pokadot Ethereum etc. The tax return for 2021 needs to be filed by the 30th of April 2022.

Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs. The adjusted cost base ACB is used to calculate the capital gains. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

Our services now included US. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. Crypto Tax Calculator.

The tax return for 2021 needs to be filed by the 30th of April 2022. 581-B rue Des Meruons Winnipeg Manitoba Canada R2H 2P6. GMS has been evolving since the early 90s offering various services.

It not only discusses all the crypto-related tax provisions but also advises you on how you can plan your taxes better. You can use crypto as an investment as a currency for spending or as a source of passive income. Report crypto on your taxes easily using Koinly a crypto tax calculator and software.

You can find your Federal and Provincial Income Tax rates in the tables above. In Canada cryptocurrency is not considered a. If you are planning on filing your taxes then make sure you also try out Koinly- which is a crypto tax calculator that fully complies with.

The resulting number is your cost basis 10000 1000 10. Backed by AirTree Ventures Coinbase Ventures and 20VC. The free trial is.

Be seen as an individual investor. Check out our free and comprehensive guide to crypto taxes. By the time you buy your new car however Bitcoin has collapsed and you sell your holdings for.

Mining staking income. Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. Guide for cryptocurrency users and tax professionals.

Making your crypto taxes easier with support for over 500 integrations. As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy a new car. Bitcoin Tax Calculator for Canada.

Cryptocurrency and Bitcoin Taxes. Calculate and report your crypto tax for free now. Tax return preparation and Canadian tax returns as well as tax and crypto consultations.

This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. Automated Crypto Trading With Haru. Paying taxes on cryptocurrency in Canada doesnt have to be a headache.

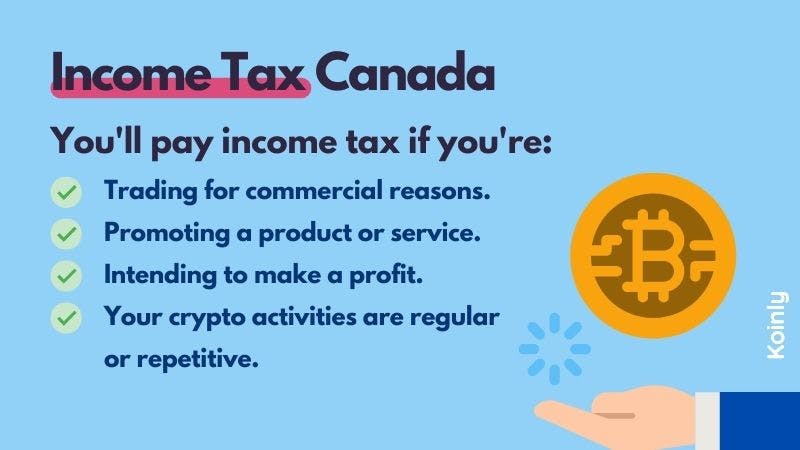

If youve had a successful year for crypto investments and youve got realized gains - the Canada Revenue Agency wants to know about it to take their cut of the profits. When it comes to Income Tax youll take the fair market value of the crypto in CAD on the day you received it and apply your Federal and Provincial Income Tax rates to the entire amount to calculate how much Income Tax youll pay. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes.

581-B rue Des Meruons Winnipeg Manitoba Canada R2H 2P6. Straightforward UI which you get your crypto taxes done in seconds at no cost. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

The resulting number is your cost basis 10000 1000 10. Crypto taxes in Canada are confusing because there are so many use cases for crypto. Each of these is accounted for and valued as a separate asset.

Gautron Management Services Inc. You simply import all your transaction history and export your report. Simply copy the numbers into your annual tax.

The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. The source data comes from a set of trade logs which are provided by the exchanges.

Covers NFTs DeFi DEX trading. If youre looking for more details on crypto taxes in Canada you can check out our free Crypto Tax Guide for Canada. You can discuss tax scenarios with your accountant.

Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains.

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Pin On Income Tax Calculators Net Income Calculators

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Cryptocurrency Taxes Canada 2022 Guide Finder Canada

Crypto Taxes In Canada Adjusted Cost Base Explained

Capital Gains Tax Calculator Ey Global

Best Crypto Tax Software Top Solutions For 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Koinly Review Is It Good For Canadians May 2022 Updated

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda